To help you better understand what to expect during and after our technology upgrade, we have compiled these frequently asked questions for your quick reference.

More Technology Upgrade Resources

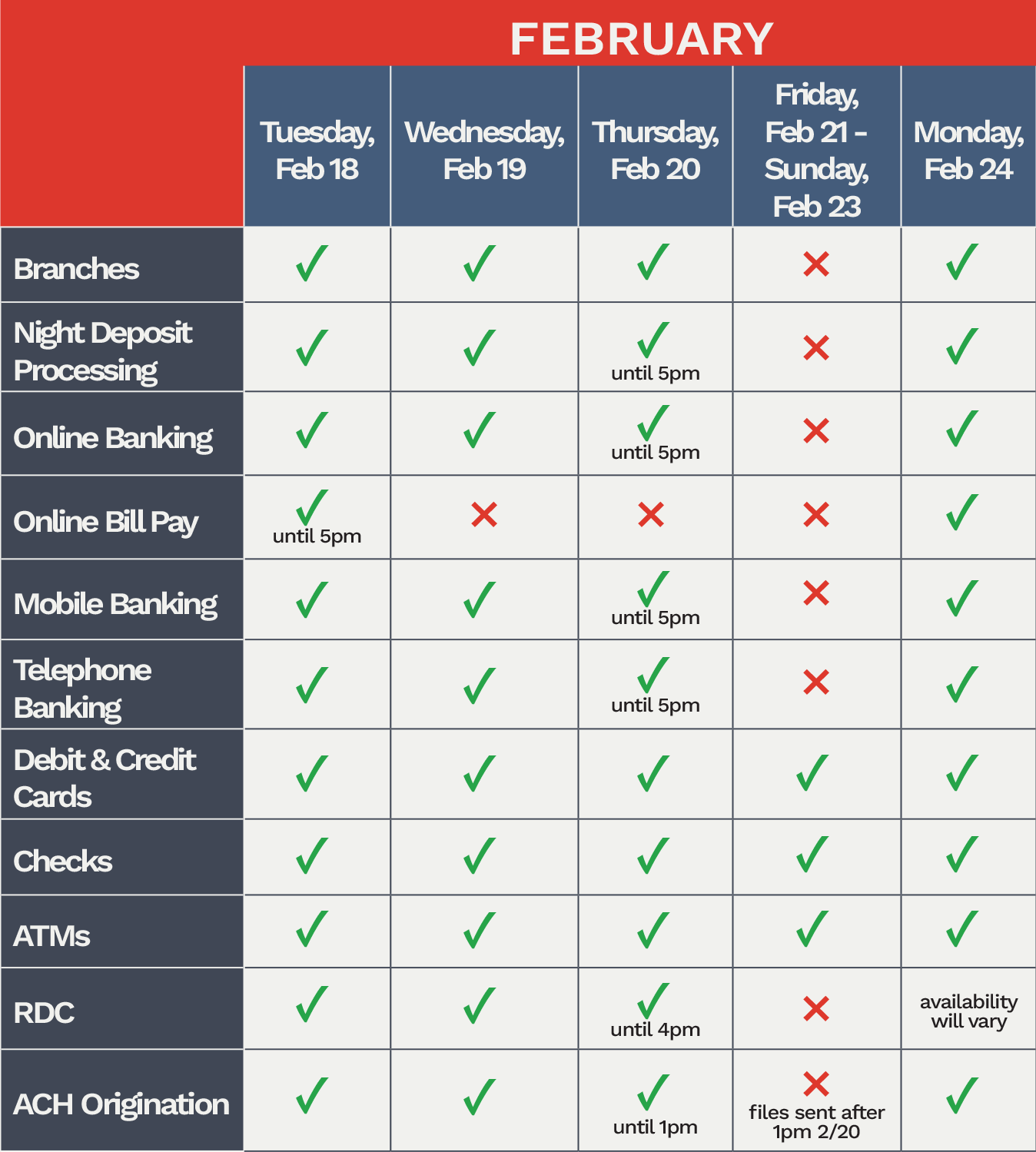

- Technology Upgrade - See the Service Availability and Schedule table for temporary service changes.

- Enhanced Business Banking and Enhanced Personal Banking - Learn about our new checking accounts, starting on Monday, February 24, 2025.

- After the Technology Upgrade - What will stay the same? What will be new? What will change?

FAQs

General

When is the upgrade happening?

The upgrade will begin at 5 p.m. on Thursday, February 20, and progress through the weekend. The bank will be closed on Friday, February 21. We anticipate services will be available again on Monday, February 24. *Please note that bill pay will be unavailable beginning at 5 p.m. on Tuesday, February 18.

The upgrade will begin at 5 p.m. on Thursday, February 20, and progress through the weekend. The bank will be closed on Friday, February 21. We anticipate services will be available again on Monday, February 24. *Please note that bill pay will be unavailable beginning at 5 p.m. on Tuesday, February 18.

What service disruptions should I expect during the technology upgrade transition?

Bill pay, online banking, the mobile app, telephone banking, Remote Deposit Capture, and ACH origination will be unavailable during the transition. See chart below. The bank will also be closed on Friday, February 21.

Accounts

Will my account numbers remain the same?

Yes, there will be no changes to any account numbers.

Will I need new checks?

No, there is no need to reorder checks. You may continue to use your existing checks.

Will my checking account change?

Yes, if you have a checking account with First State Bank, you received notifications about the updates in early January and what account type your current account will be moved into. For more information

about our new checking accounts, see:

about our new checking accounts, see:

Will I be able to switch to a different account type from what I was transferred into?

Yes, simply visit your branch or give us a call after February 24, and we will be happy to assist you in selecting the best account that fits your needs.

Will I notice any changes to my statements?

Yes, the look of your statements will be enhanced, but your account information will remain the same. We will also be changing the statement cycle. All statements will now cover a full calendar month and will be issued at the end of each month. In the month of February, customers will receive two statements: one through the 20th, and another for the remainder of the month.

Will my direct deposit and recurring payments still work during the upgrade?

Direct deposits, including paychecks and automatic/recurring withdrawals, will not be impacted and will post as normal.

Direct deposits, including paychecks and automatic/recurring withdrawals, will not be impacted and will post as normal.

Will the First State Bank routing number remain the same?

Yes, our routing number, 075907497, will not be changing.

Debit and Credit Cards

Will I need new debit cards and/or credit cards?

No, you will not be receiving new cards.

Will my debit card and/or credit cards continue to work during the conversion?

Yes, both will function as normal.

Will I be able to withdraw cash from an ATM during the conversion?

Yes, you will be able to use ATMs as normal.

Online and Mobile Banking

Will I be able to access online and mobile banking during the upgrade?

(Updated) No, online banking will be unavailable at 5 p.m. on Thursday, February 20, through 9 a.m. on Monday, February 24.

Will my online banking login credentials change?

Yes, when accessing our new online banking platform, you will still be able to use your existing user ID. However, you will need to create a new password for added security.

Will I be able to view my previous statements in online and mobile banking after the upgrade?

Statements will not be available for viewing until May. We recommend downloading any statements you may need prior to February 20 in preparation for tax time.

Statements will not be available for viewing until May. We recommend downloading any statements you may need prior to February 20 in preparation for tax time.

Will my mobile app user ID and password change?

Yes, after downloading the new app, you will still be able to use your existing user ID. However, you will need to create a new password for added security.

Online Bill Pay

Will I be able to access online bill pay?

No, you will not be able to access online bill pay beginning at 5 p.m. on Tuesday, February 18, through 8 a.m. on Monday, February 24; however, payments scheduled through February 20 will process as usual. Payments scheduled between February 21-23 will process on February 24.

What changes should I expect with bill pay during the technology upgrade?

While most of our bill payments, consumer accounts, and bank accounts will be successfully converted, a small percentage may not transfer over. As a result, some customers may need to re-enroll in bill pay, and certain bill payments or recurring payments may need to be re-established. Customers with recurring payments that do not convert will be contacted directly with instructions on how to re-establish them.

Telephone Banking

Will automated telephone banking be impacted during the upgrade process?

(Updated) Yes, it will be unavailable at 5 p.m. on Thursday, February 20, through 9 a.m. on Monday, February 24. Once you call in after the upgrade, you will need to establish a new PIN using your account number and SSN or TIN to access the new system. *Businesses will need to establish a new PIN using their account number and EIN.

Miscellaneous

If I use the night deposit boxes, when will I see the deposit in my account?

Any deposit dropped after 5 p.m. on Thursday, February 20 will not be processed until Monday, February 24.

Will my loan be affected during the technology upgrade?

No, there are no planned changes to your loan during the technology upgrade. Your loan terms and payment schedule will remain the same. If you have any specific questions about your loan, please feel free to

contact your lender directly for assistance.

contact your lender directly for assistance.

Will First State Bank contact me at any point during the technology upgrade?

Anyone who contacts you claiming to be with First State Bank, specifically asking for your personal information, is NOT associated with the bank. First State Bank will never request you provide us with

personal information such as account numbers, Social Security number, PIN, credit card number, or passwords.

personal information such as account numbers, Social Security number, PIN, credit card number, or passwords.

If there is any concern or suspicion with regard to any communication you receive from First State Bank, contact us immediately at (800) 994-2500 or email us at questions@bankfirststate.com.

ACH Origination

For Business Online Banking Only

Will my ACH files with the effective date of Friday, February 21, be affected?

ACH files submitted and processed by 1 p.m. on Thursday, February 20, will be effective on Friday, February 21. Files sent after 1 p.m. on February 20 will not be processed.

- ACH future-dated files sent before 1 p.m. on Thursday, February 20, will be processed as scheduled.

- ACH recurring scheduled transactions will be processed one day prior to the effective date. The last recurring scheduled ACH transaction will be sent by 1 p.m. on February 20, with the effective date of February 21.

Will my templates and payees that I have set up in ACH be affected?

No, the ACH templates will be available in the ACH module of the business online banking portal.Will I need a new user ID or token (hard or soft) for ACH?

The updated business online banking system will require two-factor authentication (2FA). To access the system, you can use your existing user ID but will need to create a new password using the last 4 digits of your EIN. In addition, when using ACH origination for payments or collections, a second authentication will be sent to your mobile device. You’ll need to enter this code in business online banking to complete the ACH transaction. ACH origination tokens will no longer be used, and existing tokens will no longer be valid.

The updated business online banking system will require two-factor authentication (2FA). To access the system, you can use your existing user ID but will need to create a new password using the last 4 digits of your EIN. In addition, when using ACH origination for payments or collections, a second authentication will be sent to your mobile device. You’ll need to enter this code in business online banking to complete the ACH transaction. ACH origination tokens will no longer be used, and existing tokens will no longer be valid.

Will my automatic ACH files be affected?

No, the automatic transfers will be processed as usual.

Will someone contact me to walk me through the ACH system?

Your banker and their treasury management partner can work with you to navigate the system.

Your banker and their treasury management partner can work with you to navigate the system.

Remote Deposit Capture (RDC)

For Business Online Banking Only

Will I need a new scanner for RDC?

Yes, the process will involve uninstalling the current system drivers and installing the updated ones. Your banker and their treasury management partner will reach out to you before February 20 to discuss installation options and help you choose the best solution for minimizing service disruptions.

Will the website remain the same for RDC?

The updated system will use Single Sign-On (SSO), meaning once logged in to online banking, you’ll be able to access Remote Deposit Now (RDN) without needing to sign in again with separate credentials.

Will I need a new user ID and password for RDC?

No, your user ID and password for business online banking will now be used to access Remote Deposit Anywhere (RDA) through Single Sign-On (SSO). Your current login credentials for RDC will no longer be needed.

No, your user ID and password for business online banking will now be used to access Remote Deposit Anywhere (RDA) through Single Sign-On (SSO). Your current login credentials for RDC will no longer be needed.